By checking this ratio, traders can spot probable prospects for getting very low and promoting high. A high ratio implies silver is relatively affordable compared to gold, signaling a good time to acquire silver.

For example, forex fluctuations can significantly effect the ratio. Given that gold and silver selling prices are denominated in currency, improvements in forex worth specifically have an effect on these prices, resulting in shifts inside the ratio.

Most central banking companies (New Zealand’s incorporated) are already stating the high rates of customer value inflation are just temporary and may subside as the planet returns to standard immediately after two many years of lock downs and provide chain disruptions.

By measuring the alter in the gold/silver ratio with time, buyers hope to estimate the relative valuations of the two precious metals, Therefore informing their choices of which steel to buy or offer at any specified time.

25 to one might be deemed a slender ratio. A slender ratio implies that silver’s relative worth is up and a broad ratio indicates that gold’s relative benefit is up. This ratio is an indicator that can be utilised to determine the right and Mistaken moments to purchase or provide gold and silver.

In the event the ratio widens silver turns into far more favorable for the reason that, relative to your ratio, silver is somewhat reasonably priced. Trading depending on the the gold to silver ratio is considered by several to generally be a very good technique to abide by when trying to accumulate both gold or silver.

Nevertheless the period in the preset ratio ended in the twentieth century as nations moved clear of the bimetallic currency typical and, at some point, off the gold normal entirely. Since then, the costs of gold and silver have traded independently of each other inside the free of charge current market.

With this tutorial, we will take a look at the relationship amongst silver and gold And exactly how successfully using the Gold-Silver Ratio can diversify your portfolio and optimize your investment decision tactics while in the precious metals sector.

They didn't pay a great deal consideration to silver. This concept seems to read more have adjusted in 2021 and 2022. Where we witnessed far more desire in buying silver. But so far this hasn't resulted in a significant modify during the silver rate. In 2023 there hasn't been Considerably fascination in obtaining gold or silver.

The gold silver ratio is down with the spike previously mentioned a hundred which transpired in early 2020. On the other hand as mentioned by now, with a historical foundation, the ratio nevertheless continues to be really high. Here are some feasible motives for this:

Nevertheless, that doesn’t suggest it doesn’t exist, but we look at commodities and metals as particularly challenging marketplaces to trade. Most commodity buying and selling tactics fail to generally be worthwhile and strong for very long amounts of time. Listed here you will discover far more information about our greatest buying and selling technique in various asset lessons.

Although the gold-silver ratio may be used for investing gold and silver on paper, it may guidebook the acquisition of Bodily gold and silver bullion. Buying bullion will involve purchasing physical gold or silver bars or cash Using the intent to hold them for the long run.

Currently, the gold/silver ratio floats and swings widely. Nevertheless it wasn’t like that before. For hundreds of a long time before the gold normal was transformed inside the 20th century, the gold/silver ratio was established by governments for purposes of financial balance and was reasonably continual.

Therefore, it may be an outstanding time for you to buy silver since the price is down. A decreased ratio can suggest the reverse: Gold might be a lot more affordably priced, and you might want to purchase gold even though the worth is relatively decrease than It will be in a higher ratio.

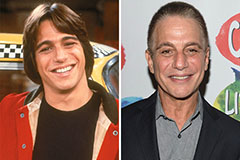

Tony Danza Then & Now!

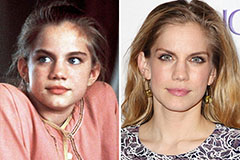

Tony Danza Then & Now! Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Jonathan Lipnicki Then & Now!

Jonathan Lipnicki Then & Now! Kelly Le Brock Then & Now!

Kelly Le Brock Then & Now! Daryl Hannah Then & Now!

Daryl Hannah Then & Now!